Table of Contents

DEXs: Final Thoughts

A Modular Future

2022: A Recap

Before we look forward, lets quickly recap 2022 to provide some context.

The new year began in euphoria with GameFi (mostly $JEWEL & $ONE, thanks Ansem) leading the charge off the back of a Nov-Dec ‘19 pump. Your favorite JPEGs (NFTs) and metaverse projects were doing well, hitting ATHs in mints and trading volume between Q1 and Q2 2022. SoLunAvax took a break from its Nov-Dec ‘19 pump in Jan ‘22 before gaining traction again towards the end of Q1 ’22.

Then came the Terra crash in May, which wiped out ~$60B in market cap in a matter of days as $LUNA and $UST went to zero while $500B was wiped from overall the crypto market in the same period.

This would not be a 2022 recap without a mention of the hacks that happened. According to DefiLlama, over $3.2B was hacked or exploited this year. In October (Hacktober) alone, $711M of hacks and exploits occurred, accounting for 22% of all hacks in 2022. Private key exploits, flashloans and price oracle attacks were among the most common exploit methods used.

Below: (1) Top 10 Hacks by Amount Lost, (2) Type of Hack/Exploit

Source: DefiLlama

Oh we are not done yet. Remember the Terra implosion in May? Yeah, that resulted in the Contagion — the effects of which are still being uncovered as of the time of writing. Here are some of its victims:

3AC (Chapter 15)

Voyager (Chapter 11)

Celsius (Chapter 11)

BlockFi (Chapter 11)

FTX-Alameda (Chapter 11)

The irony in all this is that FTX is now being investigated for having a hand in the Terra implosion. Regardless how this story continues to unfold, lets turn our attention to 2023.

2023: What Lies Ahead?

The markets continue to bleed and the Fed is expected to continue with interest rate hikes. Liquidity is scarce while tech and crypto companies continue to make workforce cuts. Suffice to say, it looks like there is more pain ahead. DCG capitulating may send the industry to new lows. Despite that, there is a sliver of light at the end of the tunnel. Builders continue to build, raises continue to raise, and degens continue to…degen. As Yoda says: Made, the bag must be. For the tech, we are in it.

Enough chat, lets talk narratives.

DEXs

Decentralized exchanges (DEXs) have been surfacing like nobody’s business. This year, DEX narratives have largely boiled down into two categories:

CLOB DEXs

GMX Clones

CLOB DEXs

Central limit order book (CLOB) DEXs exploded number this year, mostly due to the advances in blockchain scaling architecture since existing L1s are not viable options. Ethereum, the home of DeFi, does not yet (and may never) possess the capability to host such high-bandwidth and performance-hungry protocols. Solana is not capable reliable enough. Move-based L1s like Aptos and Sui, although quick, are at the moment just playgrounds for airdrop hunters (not real users), with very little economic activity for now. And BSC…well no one I know seriously considers building on BSC (which ironically makes it a very very underestimated ecosystem IMO). Thus, most CLOB DEXs had two options which, surprise, also happens to be the two main options for blockchain scaling today (more on this later):

Build on L2*

Build an Application-specific Chain (Appchain)

*“L2” in this context refers to Ethereum Layer 2s.

Building on L2 makes sense due to its proximity to the mother lode of DeFi liquidity on Ethereum. In 2021, dYdX moved from mainnet to L2 via Starkware, due to Ethereum’s inability to handle more than 15 transactions per second (TPS). The move improved trading experience by bringing down fees and provided instant settlement on trades. However, this year they turned heads when they announced their move to Cosmos in order to build its own appchain to completely decentralize its entire architecture — more on appchains later. The most popular L2 by far for DEXs seems to be Arbitrum, with deep liquidity being provided by existing DeFi protocols coming over from mainnet providing composability.

Source: mapofzones.com

The Cosmos ecosystem has been a hotbed of activity this year, especially for CLOB DEXs. Besides dYdX’s impending arrival, CLOB DEXs on Cosmos include Kujira, Injective, and Sei Network, who all deserve articles of their own (also Carbon’s Demex — which everyone always seems to forget, including myself). In short, these Cosmos L1s are a new breed of appchains and are more appropriately called “DeFi-specific” chains, or “purpose-specific” chains.

All four chains boast block times faster than the standard Cosmos chain and are built around a CLOB DEX. In my opinion, this new breed of protocols have an advantage over their L2 counterparts as they are able to build an ecosystem of products around their exchanges without fighting for blockspace on a general purpose L2, plus the bonus of being connected via IBC to other chains on Cosmos. However, it is worth noting that with advances in L2 scaling architecture, we should soon be seeing app-specific L2s to rival that of appchains on Cosmos.

One particular trend I have noticed with CLOB DEXs is that they are adopting a hybrid approach with the use of AMMs to attract liquidity and market make on the order book exchange. This IMO is a much better move than the traditional method of incentivizing trading activity via trading rewards, which usually just results in wash trading. While we may be back to square one with inflationary incentives using AMMs, Kujira has shown that it does not need inflation by making incentivization of pools permissionless, allowing protocols and community members to incentivize pools of their own choosing.

GMX Clones

Before anyone gets butthurt, I use the term “clones” here loosely for a lack of a better term that describes protocols in this category.

The success of GMX’s novel liquidity model (GLP) this year spawned clones on every DeFi ecosystem. Rather than employing an AMM or CLOB model, GMX pioneered the use of a liquidity pool where users could deposit whitelisted assets in exchange for GLP, a token representing their share of the pool. GLP holders earn a share of protocol revenue in exchange for being the counterparty of traders on the perpetual exchange. The GLP pool accrues profit when traders make losing trades and pays out profit when traders make winning trades. This model has proven very successful, with the GMX and GLP tokens outperforming most of the crypto market throughout the year. GLP remains one of the best sources of real staking yield in the market as of the time of writing, resulting in a new genre of protocols building yield aggregation and delta neutral vaults on top of GLP. The second most popular protocol with a similar liquidity model has been GNS, a synthetics leverage trading protocol that provides a large variety of synthetic markets for trading crypto, stocks, and forex.

DEXs: Final Thoughts

The DEX space is significantly saturated and poses an interesting dilemma from an investment POV. The key here, in my opinion is to look for two things: (1) a great team and (2) a great product. To expand on (2), a great product in this context would be a DEX that doesn’t just tick all the buzzwords you typically look at, like: “zero fees”, “instant settlement”, “low latency”, etc. A great DEX should stand out from the crowd and possess:

Great UX — something that you yourself would use on the daily or that your typical retail on a CEX would feel at home with

A complete suite of products — CEXs have become the super apps of Web3. Users have access to a wide variety of financial products and payment rails without the need to switch to another app. While DEXs are a ways off from being super apps, any DEX offering core products such as spot, perpetuals, options, and money markets instantly stand out from the crowd.

Thus, my personal picks (NFA) in this category are: GMX, Kujira, and Vertex.

Source: cryptofees.info

GMX stands out because it is consistently at the top of the revenue charts, showing that it has achieved significant PMF and continues to grow. The growing number of DeFi protocols building on top of GLP is encouraging, as it increases demand for GLP which in turn increases liquidity and capital efficiency of the protocol. Its position on Arbitrum also bodes well, enabling for composability with other DeFi protocols in the ecosystem. I am still cautious however, and ideally would like to see GMX weather another cycle or two.

Kujira was born out of the ashes of the Terra crash, and is known for their liquidation front-end for Anchor. Post Terra crash, the team quickly decided to launch on its own L1 and has gone on to build a suite of DeFi products around its exchange, including an AMM to bootstrap orderbook liquidity, a stablecoin protocol, and a mobile wallet with on/off ramping capabilities. The team has also teased a money market to complete its suite of products. Did I mention that its token has zero inflation and that every dApp on the network sends up to 100% of its revenue to KUJI stakers? The fact that it is trading at around $50m FDV as of the time of writing is mind-boggling to me. While we’re in the Cosmos CLOB DEX alley, Sei deserves a mention — they are making inroads to possibly be the fastest blockchain in terms of time-to-finality (TTS), but their testnet has been leaving much to be desired in terms of reliability/usability as they have not been able to keep up with the demand from airdrop hunters/botters. Will keep them on my watchlist for now.

Vertex was also born on Terra but unlike Kujira, decided to go the Arbitrum route. When it launches in 2023, Vertex will tick most of the boxes that I laid out above — which is why I think they will do well. I leave these three threads for your reference:

User-Centric Products

User-centric products are a large and important category that I feel very strongly about. Web3 has seen great adoption this year but still remains a very small market compared to the billions of users in TradFi. A large reason for this is the significant amount of user friction and poor user experience (UX) when it comes to payment infrastructure, self-custody of assets, and the fragmentation of liquidity.

Payment infrastructure has improved significantly of late as regulations start to come online, enabling Web2 giants such as Stripe and Paypal to add support for crypto. We’ve seen a number of smaller teams build payment gateways, QR pay integrations, and gift card services. We’re also seeing more Visa and Mastercard crypto card partnerships, such as with Binance and Ledger.

The great crypto paradox is that adoption and real-world usage of crypto requires some amount of centralization and regulation, while centralization has taught us that decentralization remains an important and much needed sector of crypto as seen by the FTX, Celsius, BlockFi, and Voyager implosions. Anyways, I digress.

One particular sector that I am very excited about is the area of crypto wallets. It has been 6 years since MetaMask launched and it still remains one of my least favorite wallets. No one I know has ever said they love Metamask. If you do, you’re a sociopath. We only stick with it because of how much of a hassle it is to migrate assets and the fact that we are already used to it. But, as always, first-mover advantage never lasts. The new wave of wallets will be mobile-first, do not rely on seed phrases, have multi-key security (2FA, social recovery, etc), and resemble a mobile operating system by allowing users to interact with dApps just like they would with apps on an iOS or Android device. Thus, innovations in this area can be categorized into (plus some projects I am watching):

CryptoOS & Crypto Phones

I wrote a thread on mobile devices in Web 3 back in July:

User-Centric Wallets (behave like a mobile OS where users interact with dApps from within the wallet)

This new generation of wallets will be interesting to watch. Rather than a top-down approach like the guys building crypto-first phones and operating systems, they are focusing on the gateway to crypto and are building wallets that have great UX.

Source: 1inch.io

The 1Inch wallet allows you to interact with a variety of dApps from within the wallet itself, removing the need to switch between browser and wallet which can be annoying on a mobile device.

Backpack are building a wallet ecosystem and a framework by which developers can create “xNFTs”, or apps, that users can download from a library (app store) and install into their Backpack wallet. Once this gets ported to mobile, it will behave like an OS within an iOS or Android device. As you can see from the screenshot above, apps can range from existing DeFi applications to a Wordle or Flappy Bird port. The one gripe I have is that by using the name “xNFTs” for apps, Backpack are focusing on crypto-natives rather than a potentially larger demographic of users from Web2.

Leap’s mobile wallet for Cosmos allows users to stake and participate in governance on any of the 34 (as of the time of writing) supported Cosmos chains from within the app and will soon introduce dApp browsing from within the wallet app. My only gripe is that it has a whole different app for the Terra ecosystem, which is completely unnecessary and a UX deal breaker preventing me from using it as my daily driver on Cosmos.

After more than a decade of groundbreaking crypto innovation, seed phrases remain one of the largest barriers to mass adoption of crypto. The act of storing 12 to 24 words for safekeeping without a single alternative authentication method is criminally primitive in an age where 2FA is the standard in Web2.

Obi Money are working on a seedless wallet that uses a multi-key method. The team are working towards adding a variety of keys such as:

Biometrics Key (FaceID or Fingerprint)

Magic SMS (OTP)

Social Recovery Key (Secondary Account)

Cloud Storage Key

E-Mail Key

Authenticator Application Key

Location Key

NFC Device Key

Hardware Wallet Key

This means that from the get-go, wallets are multi-sig and can be secured by more than one method. This also means that if one of the keys are compromised, an attacker would not be able to access your funds. Social recovery also leads to another much needed feature in crypto: inheritance/endowments.

Sui just released an update that enabled ECDSA R1 signatures to be supported by high-end mobile devices. This means that users can use their phone to sign blockchain transactions in addition with 2FA and other social recovery methods.

As always, one should be prudent with risk management — the addition of so many other authentication methods increases the risks involved, so I would move cautiously to adopt these new wallet technologies to secure 100% of your funds until we see more maturity and are certain of its robustness. But I do believe that this is a step in the right direction.

I believe the Obi and Sui examples are a type of multi-party computation (MPC) and multi-sig wallets (I am learning as I write this). MPC wallets have predominantly been developed and adopted by institutional users, although we are now seeing retail-focused MPC wallets like the above being developed. I recommend this article by Nichanan Kesonpat, who goes in-depth about the different type of crypto wallets. One interesting development to watch on mainnet would be the introduction of Account Abstraction in combination with Ethereum Contract Accounts (CAs), which L2s like Starkware (already supports) and zkSync (soon) have done.

The Appchain Thesis

Ahh, the evergreen problem of blockchain scalability — one of the esteemed members of the blockchain trilemma. The following is an excerpt from an unreleased article that I wrote about a month ago:

The blockchain scalability issue has been a persistent one and has arguably been the driving force behind most developments in blockchain architecture. The quest for a highly scalable Ethereum network led to the rise of proof-of-stake (PoS) blockchains, sidechains (Polygon, Ronin), Layer 2-(L2) solutions such as rollups (Optimism, Arbitrum), and other modular solutions (Celestia, Fuel, Nitro, Eclipse, EigenDA).

Other blockchain ecosystems with their own take on scalability have also materialized, for example Cosmos and its appchains, Polkadot and its parachains, and Avalanche and its subnets, among others. Each of these solutions have their advantages and disadvantages and are not perfect by any means.

Of all these scaling solutions, I believe Cosmos’ Appchain Thesis to be the near to mid-term winner. The Appchain Thesis is essentially this: rather than trying to scale an L1 to support multiple protocols and their growing economic activity, why not build a new L1 customized and optimized for each protocol and connect them all together? The Tendermint + Cosmos SDK stack is unrivalled in the ease that it allows anyone to spin up a fully operational blockchain — from shitcoin chains within hours (Joe Chain) to complex high-performance DeFi-specific chains (e.g. Sei Network). dYdX was the first major DeFi protocol from Ethereum to signal its intention to build an appchain, proving the PMF of appchains. Most recently, Circle announced its appchain to finally bring native USDC to Cosmos.

We’re now seeing Ethereum move towards this same appchain blueprint. The post-Merge roadmap showed that scaling mainnet in the near future will revolve around optimistic rollups (ORUs) and zk rollups (zkRUs). Take that one step further and you have app-specific rollups, or RollApps, the rollup version of appchains.

Source: Fuel Labs

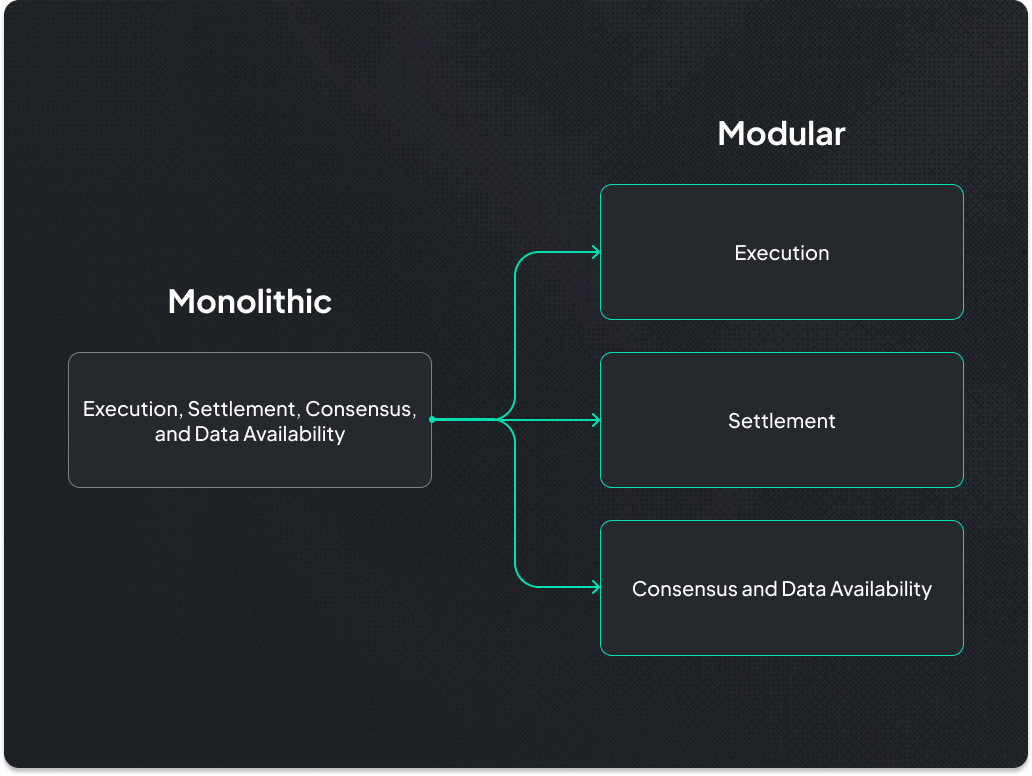

Gone are the days of monolithic L1s. A host of modular solutions (image below) make building blockchains like Legos, allowing developers to separate the Settlement, Execution, Data Availability, and Consensus layers. Dymension are taking the Cosmos blueprint and applying it to rollups, making it easy for any team to spin up their rollups with ease — just like appchains on Cosmos.

One downside to the appchain thesis is that it is done at the cost of synchronous composability. More on that below as we take a deeper look into Cosmos.

The State of Cosmos

As of the time of writing, there are 53 chains in the Cosmos ecosystem connected via IBC — a 65% YoY increase from last year’s 32. The ecosystem has seen a huge drop in IBC volumes since the Terra implosion, which makes sense since Terra accounted for most DeFi activity on Cosmos. However, the launch of perpetuals, money markets, and other lending protocols across the Cosmos recently and in the upcoming quarter could be a catalyst for user activity. We’re also are seeing efforts to connect:

IBC chains with non IBC chains (Polymer)

Cosmos SDK chains with non-Cosmos SDK chains (Penumbra)

EVM and Cosmos chains (Electron Labs)

Reference: IBC Protocol Review 2022

Source: mapofzones.com

Despite the apparent PMF of appchains, I am personally looking at DeFi-specific chains like Kujira, Sei, Injective, and even Terra, who have been continuing to build innovative infrastructure and tooling after the crash. Delphi’s Astroport and Mars protocols remain on my watchlist. The reason why I am bullish on “DeFi-specific” chains and prefer the idea of such (as opposed to “application-specific chains”) is that meaningful economic activity can only occur when there is an ecosystem of products that users can use. “But Ian, isn’t that the whole reason for IBC, that appchains can talk to each other and are collectively the Cosmos ecosystem?”

Well, the current state of IBC relayers is not conducive to achieving synchronous composability between appchains. It may enable asynchronous composability, but it is not enough. Synchronous composability is when interactions between applications can occur within the same block. This is vital for trading and yield strategies to reduce slippage and prevent frontrunning. IBC enables asynchronous composability, which is composability between protocols where interactions occur within an undefined and variable amount of time. IBC relayers are slow, unprofitable to run, and unreliable —thus are only useful for transferring assets between chains and is not ideal for things like cross-chain trading or advanced yield strategies incorporating protocols on multiple chains. While ICS 29 may help improve reliability, reliability alone won’t be enough if transactions between chains take longer to settle than on-chain transactions.

As such, DeFi activity on Cosmos in the near future will be confined to DeFi-specific chains. Just to prove that I’m not crazy to think so, Mars Protocol in their whitepaper, states their plans to launch native outposts on various chains to achieve synchronous composability, as it is simply not possible with cross-chain calls. However, we can look forward to improved asynchronous composability with developments like Axelar’s GMP, which Squid is using, or Circle’s CCTP. Keep an eye also on cross-chain messaging protocols like Router Protocol, Synthr, etc.

A Modular Future

So the $100 question: which blockchain scaling method is better? This sounds like a cop out but I do think it depends on what each protocol needs. The following opinions are based on the state of Ethereum L2s and Cosmos appchains at this point in time.

Scenario 1: If a protocol requires a highly-performant chain that can be customized and optimized for their needs, then a Cosmos appchain would be my pick. This is because I believe that nothing yet rivals the customizability of the Cosmos SDK + Tendermint stack. The team at Sei Network have shown just how this is the case with their work on intelligent block propagation and optimistic block processing. With Celestia coming online soon and Nitro building the first Cosmos L2, this will kickstart the modular era of Cosmos appchains and provide more customization for developers.

Ethereum L2s should not be underestimated however, as I believe that we will be seeing application-specific rollups very soon. Modular blockchain solutions like Celestia, Fuel, Eclipse, EigenDA, etc are all coming online soon. However, “RollApps” will suffer the same fate as Cosmos appchains in terms of having asynchronous composability at best, at least for now.

Scenario 2: If a protocol requires proximity to Ethereum for its network effects and superior liquidity, then an L2 rollup makes more sense. This is not to say there is a lack of customizability — in fact, the host of modular solutions as discussed previously points to exactly the opposite. I just think that the Cosmos stack has had much more development behind it, has had ample time to deal with critical security issues, plus upgrades from various chains can be up-streamed to the rest of Cosmos since each chain is using the same stack.

Thus, there is no one winner and I am fairly certain that the space is large enough for both ecosystems (Ethereum and its rollups and Cosmos and its appchains) to do well. IMO, the near future of blockchain scalability will converge towards one that is modular and filled with DeFi-specific “appchains”. The crypto utopia is that both ecosystems (and others) will ultimately converge and be completely composable.

DeFi 3.0: Real Yield & DeFi Banks

Real Yield

DeFi 1.0 gave us AMMs and yield farming while DeFi 2.0 gave us POL and veTokenomics. The next chapter of DeFi is the #realyield movement.

Protocols like GMX, GNS, Synthetix, etc were brought into the limelight during the #realyield craze a few months ago, when investors started to shift their focus towards protocols that rewarded its holders with a share of protocol revenue. However, one should note that if token incentives > revenue, then the protocol is in fact running at a loss. This is why GLP has been so popular, since its holders are earning pure profit as opposed to GMX holders who have to bear with inflationary emissions.

CeDeFi Lending protocols offer an alternative for users looking for yield — up to double-digit APRs on stablecoin deposits. Of course, these come with higher risks, which have been highlighted of late as a result of borrowers becoming insolvent post-FTX collapse. Protocols like Maple, TrueFi, Clearpool, Goldfinch, and Ribbon Lend are just some of the names in this category. While they are high-risk for now, they will be staples in a bull market when demand for capital increases. We will likely be seeing more DeFi <> CeFi collaborations, especially in the lending sector and with real-world asset (RWA) integrations.

DeFi Banks

This brilliant thread by @saypien_ of Messari breaks down the shift in DeFi business models towards a liquidity service model.

Protocols like Aave, Curve, and Frax are all moving towards this model. Simply put (if you did not read the thread above), by issuing their own stablecoin that accrues interest revenue and by owning demand services like DEXs and money markets, these protocols are able to generate much more revenue at lower costs (without inflationary emissions). I call these DeFi banks because they provide a vertically-integrated, revenue-generating financial ecosystem where users can go to lend, borrow, and earn — just like a TradFi bank. In an age where granddaddy protocols are running out of tokens to issue, revenue generation and continued growth in demand by providing key services is…key. The age of inflationary emissions to bootstrap demand and acquire customers is over. The customers are here, now make them stay.

Decentralized Social Media (DeSoc)

DeSoc has always been on the edge of my radar. The social media industry in Web2 is the largest in terms of revenue share for advertisers and is the reason why content creators and influencers exist. DeSoc on the other hand has struggled to gain any sort of meaningful traction from both users and developers to merit any of my time — until now.

Lens Protocol saw some great growth in 2022, especially towards the end of the year.

Source: Dune

As of the time of writing, Lens are quickly approaching 100K users. Bear in mind that they are still in closed testing phase, with users being added regularly via invites from the team. Decentralized social graphs make building social applications so much easier, not to mention the composability. We’re already seeing some dApps that resemble their Web2 counterparts such as:

Lensta - Instagram

Orb - Twitter

Pinsta - Pinterest

Phaver - Reddit

Lenstube - YouTube/TikTok

This space will only continue to grow, driven by the following factors:

Censorship of mainstream social media platforms

Data privacy issues

Lack of ownership of personal data

Improved Web3 infrastructure

Potential for gamechanging dApps and composability with DeFi ecosystems

If you read this far down, you’re insane. Thank you for reading and have a great year ahead!

Disclaimer: This article is for entertainment purposes and does not constitute financial advice. All opinions are my own. I am invested in some of the tokens and projects mentioned within the following article. This statement discloses any conflict of interest and is not a recommendation to purchase any of the mentioned tokens.