Ian's Intel #1

The inaugural issue. My Portfolio? LSDFi, Intents, Cosmos, and more!

Inspired by Linn's Leverage, I’m attempting to put thoughts and alpha down into words with some sort of regularity. This newsletter series will be free for all readers and if there’s some demand, I might consider adding a paid section at the end of each issue to share my personal portfolio.

What I like about reading newsletters and alpha aggregators is that I get to catch up on things that I do not have a pulse on. One can only stretch themselves so much but it is always great to look outside of your info bubble — I hope this newsletter does the same for you! My radar consists of DeFi and infrastructure on Ethereum and its L2s, as well as the Cosmos ecosystem.

Let’s dive in.

LSDFi

The hot topic of the last few months. I am relatively late to this but IMHO this is a sector of huge potential that is still in its early stages.

First, wtf is LSDFi? It is a marriage between Liquid Staking Derivatives (LSDs) and decentralized Finance (DeFi) — LSDFi. The concept is not a new one: take yield-bearing assets and build shit on top of it. We’ve seen this playbook a number of times now!

Terra’s multi-billion dollar ecosystem was built on top of UST, which had an APY of ~20% for most of its short-lived life. GMX’s GLP has been so consistent with its real yield that it now has a number of protocols built on top of it. In short, yield tokens form the foundation for a ton of yield strategies and applications such as borrowing and lending, yield strategies, leverage, etc.

You might even have realized by now that this is a play taken from TradFi — yep, treasury bills (T-Bills). T-Bills form the foundation of familiar financial products and strategies like money market funds, short-term loans, hedging strategies, etc.

The protocol that everyone is talking about when it comes to LSDFi is Pendle.

PENDLE

Pendle has garnered some attention recently, mostly due to its impressive performance and is up about +1500% since the turn of the year. There are already a ton of brilliant threads and articles about Pendle, so I will not dive deep here.

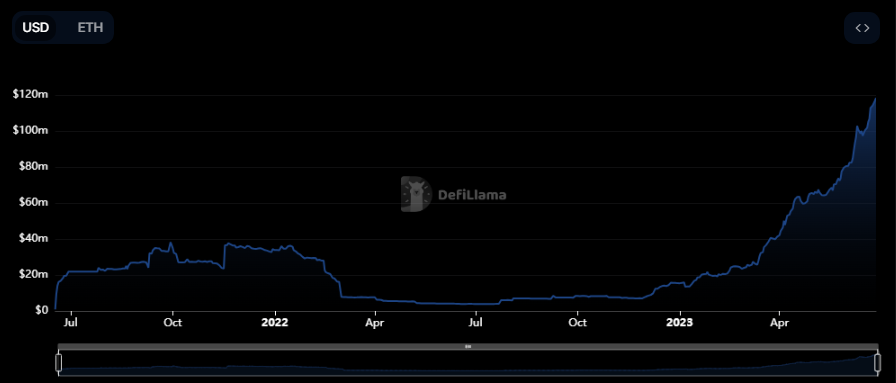

Pendle’s TVL has grown impressively since the launch of its V2, with over $110M TVL while trading at a market cap of $75M as of the time of writing. Since Pendle’s tokenomics are based on Curve’s veTokenomics, PENDLE Wars are inevitable and has already begun with Equilibria and Penpie.

Despite its explosive growth, I think this sector will be highly competitive. Users flock to places that give the highest yield with the lowest risk on the various LSDs and thus there is little moat here IMO.

Mantle Network

Mantle Network has begun to position itself to fully embrace LSDFi by building its own LSD, mntETH, as well as a potential collaboration with Lido. All the alpha is in this forum post here and this Twitter Spaces here.

There’s also a gap in valuation of BIT, soon to be MNT, (the utility, governance, and gas token of the Mantle Network L2) when compared to competitors like OP and ARB.

For a deep dive into Mantle Network, I highly recommend you sub to Blockcrunch VIP and read my full report.

Now for some ALPHA…

Mantle Airdrop

Although since deleted (you can still find the page cached by Google), Mantle’s docs confirmed that there will be quests and incentive programs, aka AIRDROPS. Bear in mind that since the team have deleted the post, things can change.

BUT…

On the Mantle Discord, there is an upcoming role called “Wadsley Guild Membership”. And from the role’s description, it seems that it can only be earned if if you complete the “full series of testnet quests on Zealy (formerly Crew3).

This is still ongoing, so get started now via my invite link!

Intents

Intents have also been gaining some traction, albeit among the nerdy part of CT. Still super early, but this has the potential to redefine how users interact with the blockchain. I also think development around intents will be significantly accelerated by the rise of AI tooling.

Below is my read/watch list on the topic.

Whitepapers

1. Anoma

Articles

1. Intent-Based Architectures and Their Risks

Videos

1. Adrian Brink - Intent-centric (intent-solver pattern) architectures for fully decentralized dApps

2. Realizing Intents with a Resource Model - Christopher Goes

3. Are Intents, SUAVE, Account Abstraction, & Cross-Chain Bridging all the same thing? - Uma Roy

4. I Think This Stuff is a Dead End - Zaki Manian (

5. Is Intent-Based Architecture a Major Breakthrough Like Bitcoin & Ethereum?

Spaces

1. Celestia - Exploring Intents, w/ Zaki Manian, Nick White, Christopher Goes, Uma Roy

Cosmos

Nolus

If you’re looking for yield on USDC in Cosmos, Nolus is paying you 15% APY in NLS tokens to deposit USDC on their platform.

Whale

Whale incentives are now live on Chihuahua chain.

Inter Protocol

IST Vaults are going live soon, where you’ll be able to mint IST (stablecoin) with ATOM. Previously, you were only able to mint IST with axlUSDC and axlUSDT.

Akash

Akash’s venture into AI continues. Their GPU Testnet is still ongoing, with mainnet scheduled to launch in over two weeks time.

P.S.

There is a significant gap in valuation between AKT and its competitor, RNDR.

TFM

TFM are one of the top builders on Cosmos. Their most recent innovation is the ALOB (aggregated limit order book). SICK.

NATIVE USDT

FINALLY, we get native USDT on Cosmos. Launching July 3rd.

Disclaimer

The content provided in this newsletter is for informational purposes only and does not constitute financial advice. The author and the newsletter are not responsible for any decisions made based on the information provided herein. The opinions, analyses, and information included are based on the author's perspective and while believed to be accurate, should not be relied upon without conducting your own research and due diligence.

Additionally, the views and opinions expressed in this blog are those of the author alone and do not reflect the views, policies, or positions of any organizations the author is affiliated with or contributes to. It is always advisable to consult with a qualified professional before making any financial decisions. All investments involve risks, including the potential loss of principal.

Yooo, this is great. Can you ping me a message on Twitter? Will give it a share in the newsletter