Ian's Intel #48

IS IT OVER?

This newsletter series is free for all readers.

What I like about reading newsletters and alpha aggregators is that you get to catch up on things that you do not have a pulse on in your day-to-day. One can only cover so much on their own, so it’s always great to look outside of your info bubble — I hope this newsletter does the same for you!

Note that you can click on the screenshots of each tweet in this newsletter to take you to the actual tweet.

Our Telegram Channel is FREE and shares news/alpha in real-time.

Let’s dive in.

Market Shock: How Japan's Rate Hike Crashed Global Markets

Japan's sudden interest rate hike to 0.25% has caused a major sell-off in global markets, disrupting the "JPY carry trade". This strategy involves borrowing yen at low rates, converting them to USD, and investing in US stocks.

Here's how it works:

Borrow Yen at Low Rates: Traders borrow Japanese yen at very low-interest rates.

Convert to USD and Invest: They convert the yen to USD and buy US stocks.

Interest Rate Hike: The Bank of Japan raised interest rates, making yen loans more expensive.

Yen Strengthens: The yen strengthens against the USD, causing huge forex losses for traders.

Adding to the panic are fears of an escalating Middle East conflict, US political uncertainty, this combination of factors is fueling investor anxiety and market volatility

The VIX opened at 65 yesterday, before closing at 38 to print the largest daily high - daily close ever — an indication of the heightened market volatility we saw yesterday.

We saw similar drawdowns across Asian markets — the Nikkei experienced its biggest one-day drop (since 1987) yesterday before retracing it completely today. Who said only crypto experienced such volatility!

On to our usual updates.

New Listings

Stader ($SD) listed on Coinbase spot

$LAVA listed on Aevo futures

$L3 listed on Bybit futures

cat in a dogs world ($MEW), Memecoin ($MEME), Jasmycoin ($JASMY) listed on Coinbase International futures

$ONDO listed on OKX futures: Aug 6 at 10:30 UTC

$PENDLE listed on Upbit spot

DeFi

Binance Labs announces first batch of projects admitted into Season 7 Incubation

Circle Said to Be Trading Around $5B Valuation Ahead of Planned IPO — Coindesk

Compound drama resolved: "hostile" proposal cancelled in favour of new proposal for a fee sharing mechanism. 30% of existing treasury and 30% of net new protocol revenue to be directed to staked COMP

Lido announces Lido Institutional

The snapshot of Season 1 for deBridge has been taken

Aave DAO launches Lido-specific market

L1, L2, & Infrastructure

USDT: Tether Releases Q2 2024 Attestation: Reports Record-Breaking $5.2 Billion Profit In First Half Of 2024, Highest Treasury Bill Ownership Ever and Largest Ever Group Consolidated Equity At Almost $12 Billion

DWF Labs announces that it's working on a CeDeFi synthetic stablecoin

Bitcoin/ETH/SOL ETFs

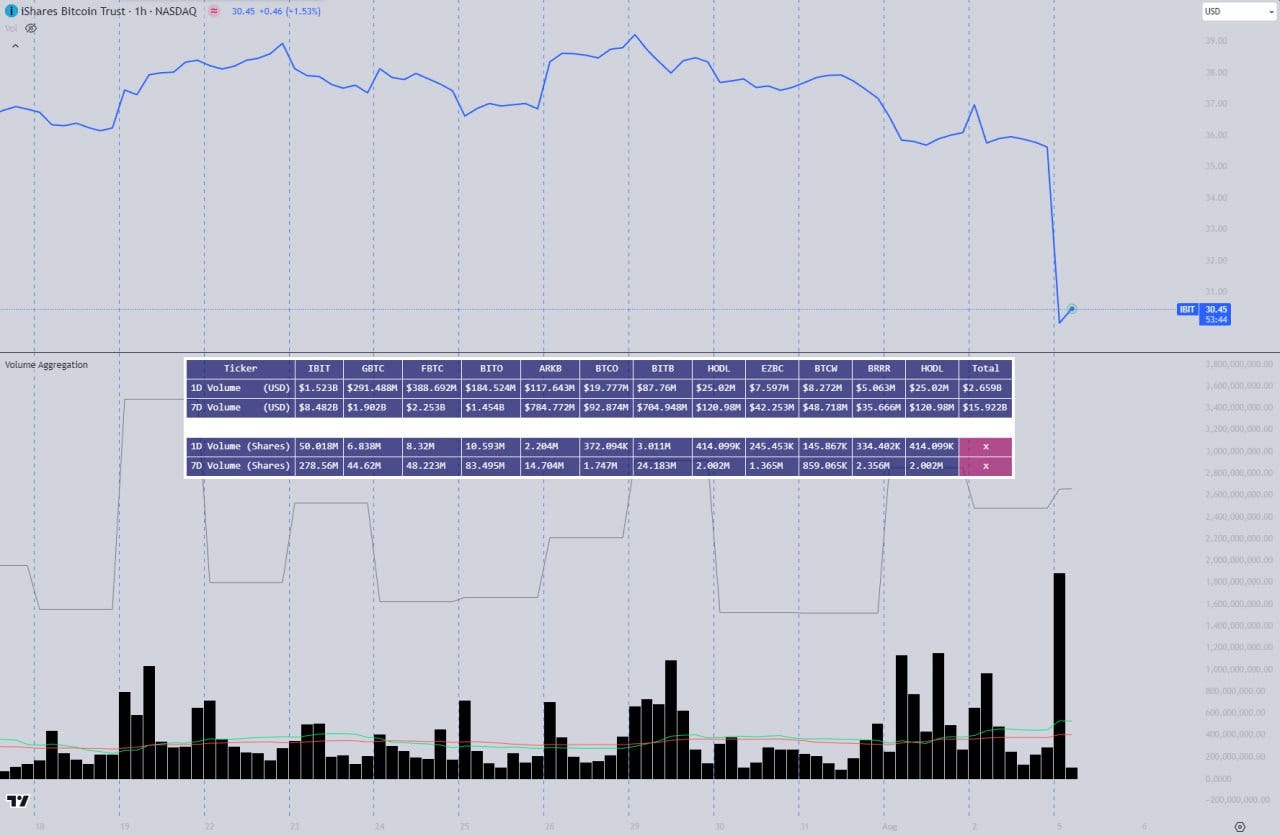

BTC ETF

ETH ETF

Nate Geraci on SOL ETF chances — Link

BLACKROCK IBIT'S TRADING VOLUME EXCEEDED US$1.5 BILLION IN FIRST HOUR on August 5th

Rules & Regulations

US GOV MOVES $2B IN SILK ROAD COINS — ONCHAIN

SEC MOVES TO AMEND COMPLAINT AGAINST BINANCE, SEEKS TO NO LONGER PROVE TOKENS SUCH AS SOLANA ARE SECURITIES — FILING

FOUNDER OF BITCLOUT CHARGED BY THE SEC — SEC

U.S. Strategic Bitcoin Reserve to be funded partly by revaluing Fed's gold, draft bill shows — Coindesk

FED LEAVES RATES UNCHANGED AT 5.25-5.5%

Bybit to completely close down operations for French users

THE BLOCK: CFTC subpoenas Ben ‘BitBoy’ Armstrong’s former company in fraud investigation, asks about activity for tokens such as BEN

Rugs & Exploitations

Terra exploited after reverting the upgrade* that patched critical IBC-hooks exploit in April

Reads & Tools

Jump crypto dumping

Trump raises $25M at Bitcoin Conference fundraiser — Eleanor Terrett

Coinbase beats earnings, $1.45B in revenue vs $1.39B — Earnings

Microstrategy to raise another $2B — Press Release

Sahm rule triggered — fejau

Hackers bought the ETH dip

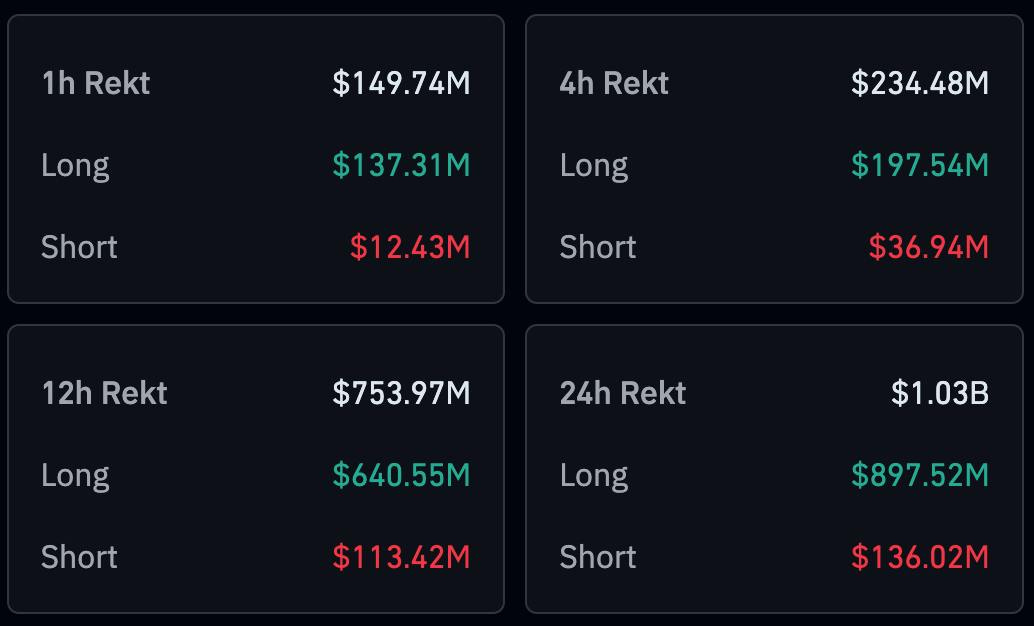

Update: >$1b liquidated in 24hrs on August 4

Disclaimer

The content provided in this newsletter is for informational purposes only and does not constitute financial advice. The author and the newsletter are not responsible for any decisions made based on the information provided herein. The opinions, analyses, and information included are based on the author's perspective and while believed to be accurate, should not be relied upon without conducting your own research and due diligence. The author may or may not be invested in any of the projects or tokens mentioned in the newsletter.

Additionally, the views and opinions expressed in this blog are those of the author alone and do not reflect the views, policies, or positions of any organizations the author is affiliated with or contributes to. It is always advisable to consult with a qualified professional before making any financial decisions. All investments involve risks, including the potential loss of principal.